4

Min. ReadAfter three record years in a row, the watch industry is closing the first half of this year struggling with difficulties.

After three record years in a row, the watch industry is closing the first half of this year struggling with difficulties.Financial reports from brands and groups reveal pessimistic notes, prices on the secondary market are contracting, inventories are increasing, waitlists are decreasing, and speculation is reducing. What is the situation for the first semester of 2024? Let’s have an overview using the latest reports and analytics available.

The watch industry saw a remarkable rebound in 2021 after the pandemic, with exports up 31.2% compared to 2020. This growth continued into 2022 and 2023, reaching record levels. However, signs of a slowdown appeared towards the end of 2023. The first half of 2024 confirms these trends, with the Federation of the Swiss Watch Industry (FHS) reporting a 7.2% fall in June exports compared to 2023 and a 3.3% reduction for the first half of the year.

The historic fall of the watch industry in 2020 due to the global pandemic.

The decline in exports is primarily due to lower demand in Asia, particularly China (-21.6%) and Hong Kong (-19.9%). Saudi Arabia also saw a 16% drop. Elsewhere in Asia, declines were noted in Singapore, the UAE, and South Korea. However, Japan experienced a rise in exports due to foreign visitors taking advantage of a weak yen. The USA continues to report growth, while Europe remains relatively stable.

Geographical breakdown and evolution of Swiss watch exports, first semester 2024 – Source: Federation of the Swiss Watch Industry

Swatch Group reported a 14.3% decline in sales for the first semester of 2024, mainly due to weak demand in China. Richemont Group saw a 1% increase in sales for the first quarter, with jewelry brands performing well, but its watch division struggled with a 13% drop in sales. LVMH reported a 2% decline in Q1 sales, with a 5% drop in the Watches & Jewelry division.

Inventory levels are rising, with Richemont reporting a 12% increase to EUR 7,980 million and Swatch Group's inventories up 5.5% at CHF 7,708 million. These increasing inventories indicate potential overproduction and reduced sales.

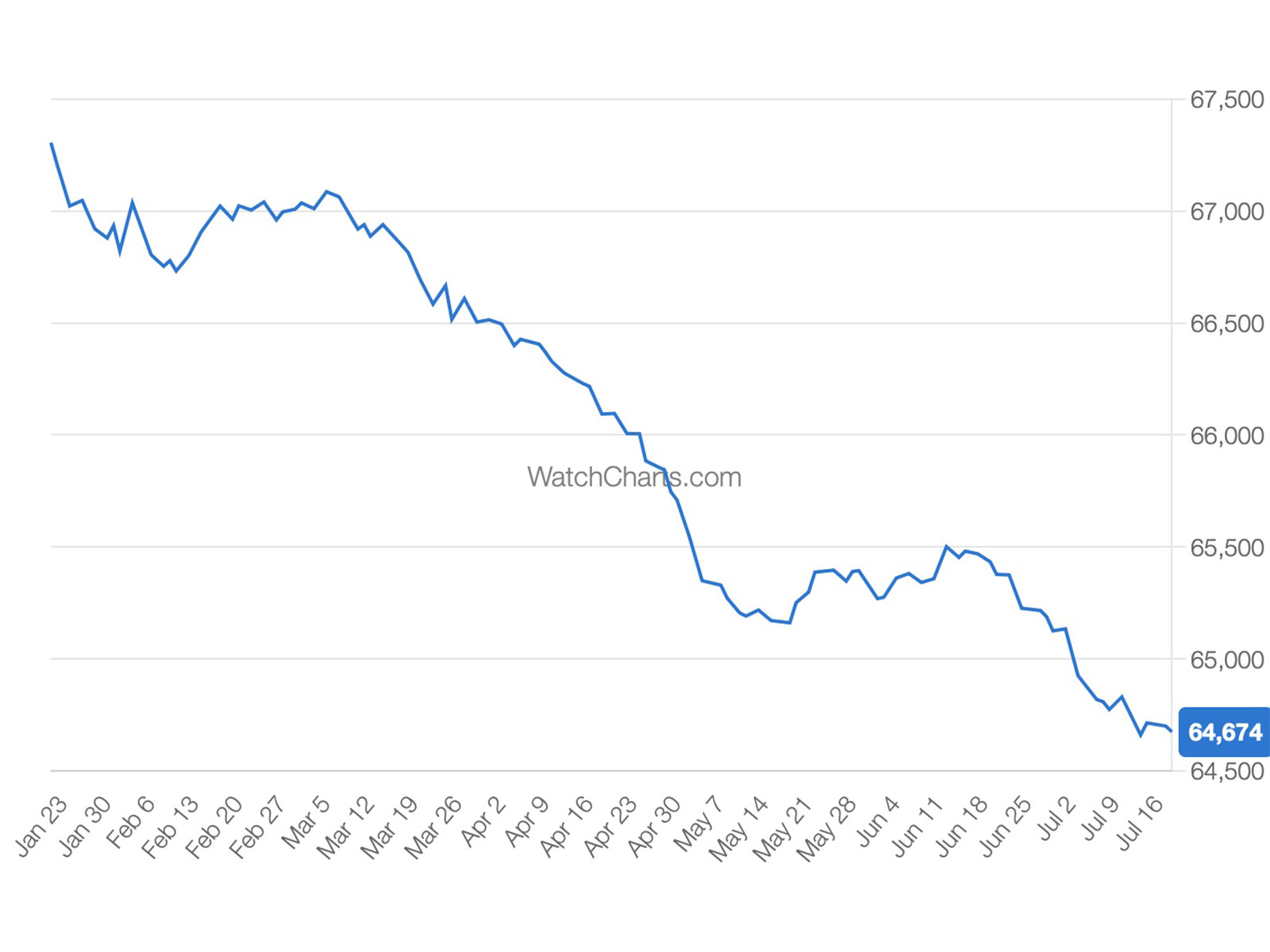

The secondary market is also facing challenges, with WatchCharts reporting nine quarters of declining prices. The WatchCharts Overall Market Index has lost about 3.5% since January 2024. The ChronoPulse index shows a slight rise in prices in June-July 2024 before stabilizing.

The ChronoPulse Watch index (Chrono24) for the first semester of 2024

WatchCharts Overall Market Index for the first semester of 2024

The mood within the industry is not positive. Brand representatives report higher inventories and lower sales, with rotation periods at retailers getting longer. While the situation is concerning for brands, it presents opportunities for watch enthusiasts. The market is becoming a buyer's market, with more availability and potentially negotiable prices.

Average waiting time for selected Rolex models – Source: WatchCharts

The watch market in 2024 is experiencing a correction after three exceptional years. While brands face challenges, watch enthusiasts can benefit from the current market conditions. The cyclical nature of the economy means this downturn is part of a natural process, and the industry is expected to adapt and recover over time.